Tax Inclusive Accounting

Tax Inclusive Accounting

Use Case: Tax-inclusive pricing includes the sales tax paid by the customer in the total price of the item.

For instance, if an item costs $100 with a 10% tax rate, the customer still pays $100, but $9.10 is collected as tax. To configure this, follow the steps below:

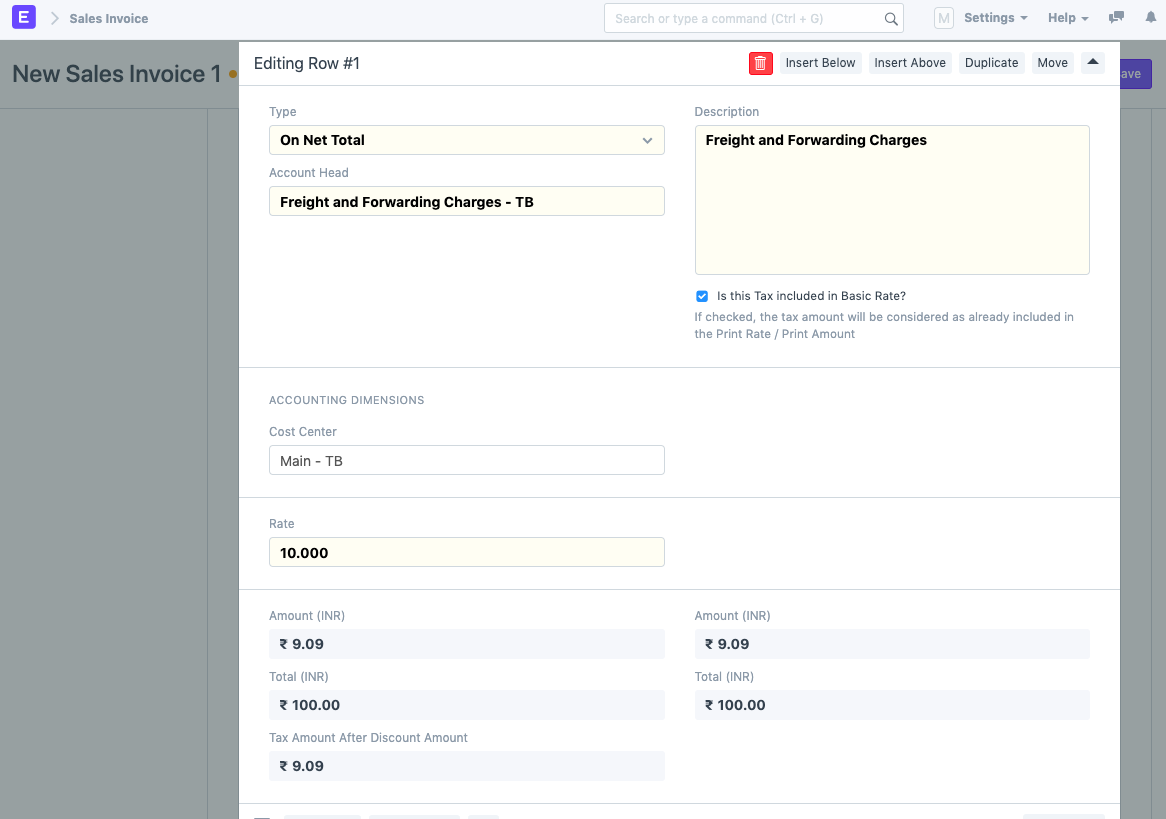

1) Navigate to the table view of the tax in question in the Sales Taxes and Charges section and expand the row.

2) Check the box next to "Is this tax included in the basic rate?"

The system calculates the tax in reverse.