Naming Series as Per GST Rules

Naming Series as Per GST Rules

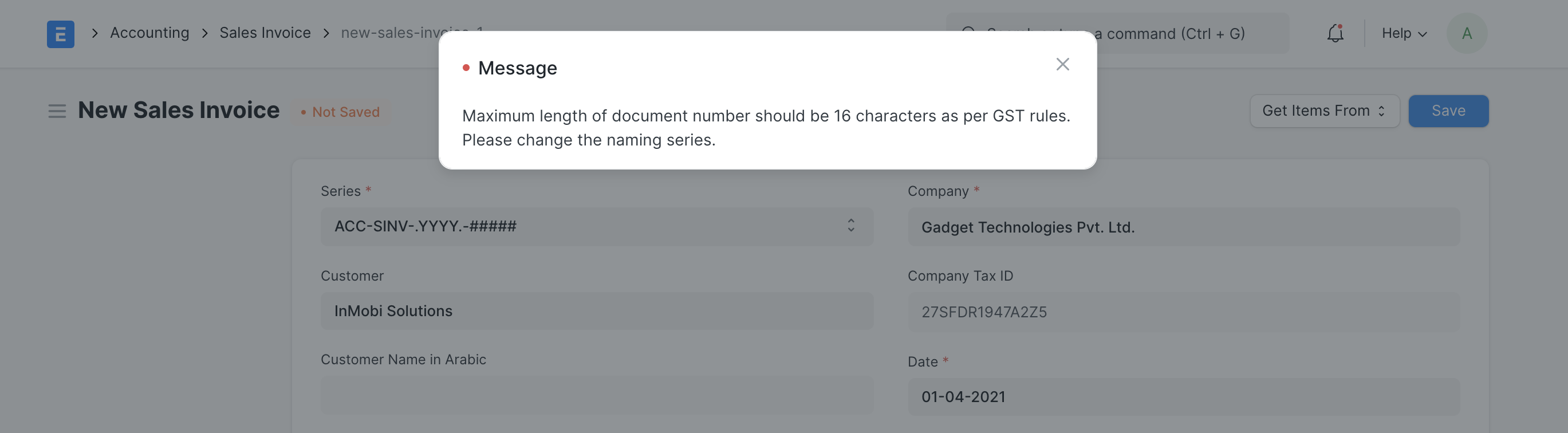

Rule 46 (b) of the CGST Rules 2017 stipulates that a tax invoice issued by a registered person must have a consecutive serial number of not more than sixteen characters, in one or multiple series, containing alphabets or numerals or special characters – hyphen or dash and slash represented by "-" and "/" respectively.

This validation will be implemented in ERPNext beginning with the 2021-22 fiscal year. Follow the steps below to resolve the error and add a new naming series for Sales and Purchase Invoices if you encounter an error similar to the one depicted in the screenshot.

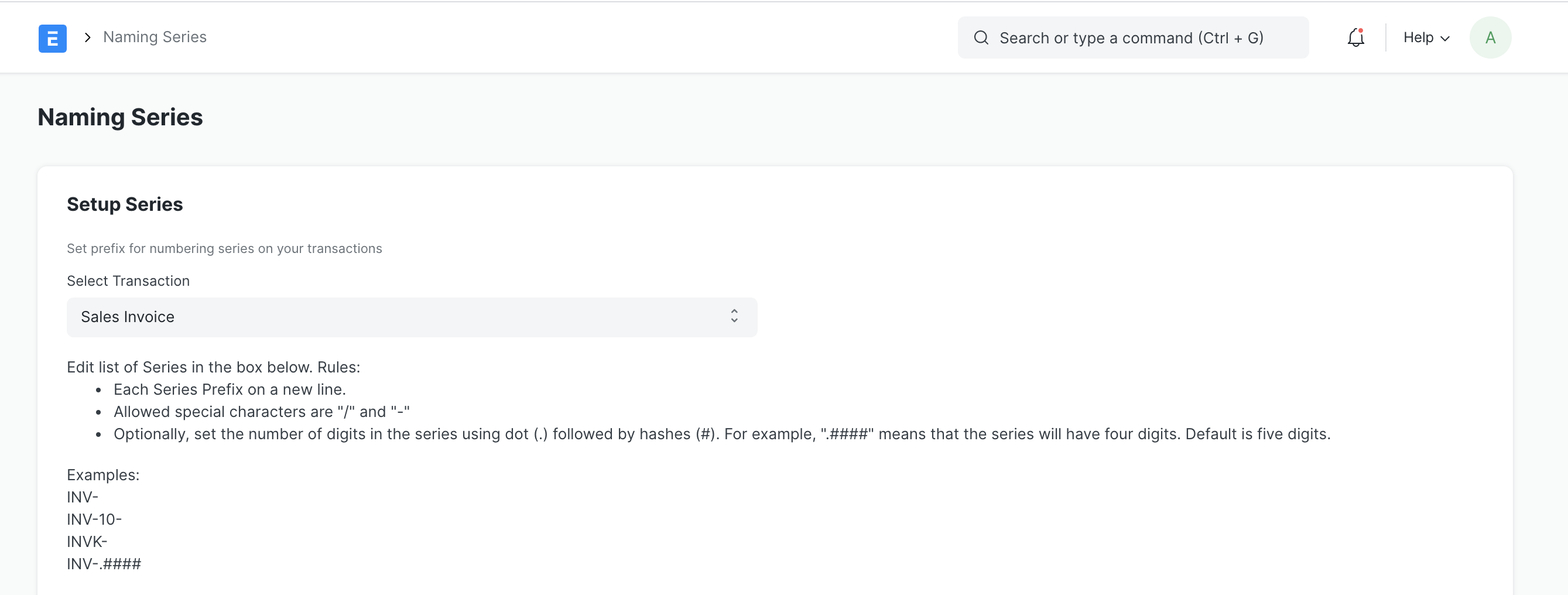

Step 1: Navigate to the "Naming Series" doctype and select "Sales Invoice" as the transaction.

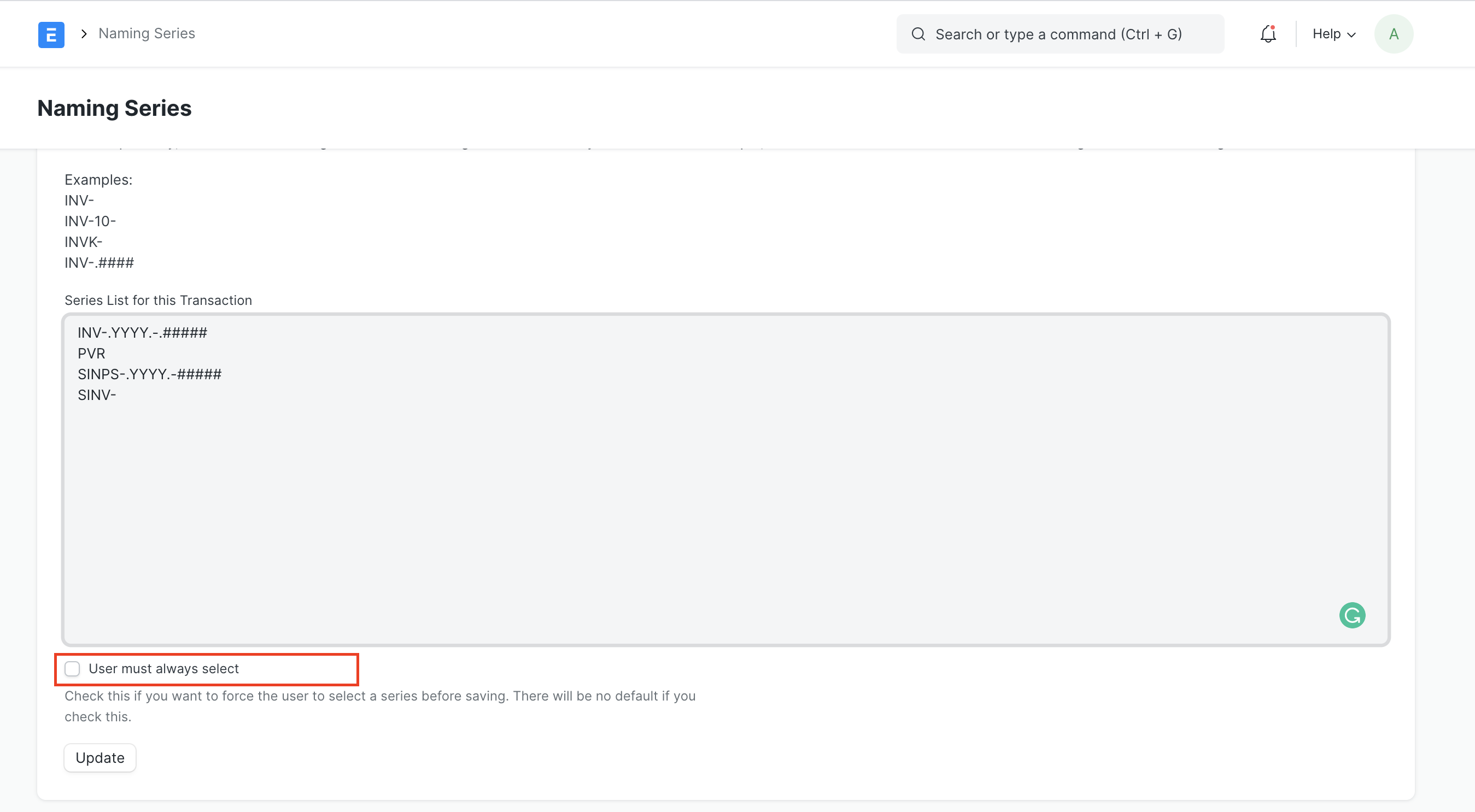

2.Add a new naming series with a maximum of 16 characters in Step 2. For eg INV-.YYYY.-.#####. To make this the default naming series, add this as the first option and uncheck "User must always select."