Income Tax Slab

Income Tax Slab

A document called Income Tax Slab is used to specify income tax rates based on various taxable income slabs.

In many nations, individual taxpayers are subject to income tax based on a slab system in which different tax rates have been established for various income slabs, and these tax rates continue to rise as the income slab increases. With the help of Salary Structure Assignment, you may build different Income Tax Slabs in ERPNext and connect them to the pay structures of specific employees.

Go to: to access Income Tax Slab.

Home > Human Resources > Payroll > Income Tax Slab

1. How to create an Income Tax Slab

Establishing a new income tax slab involves:

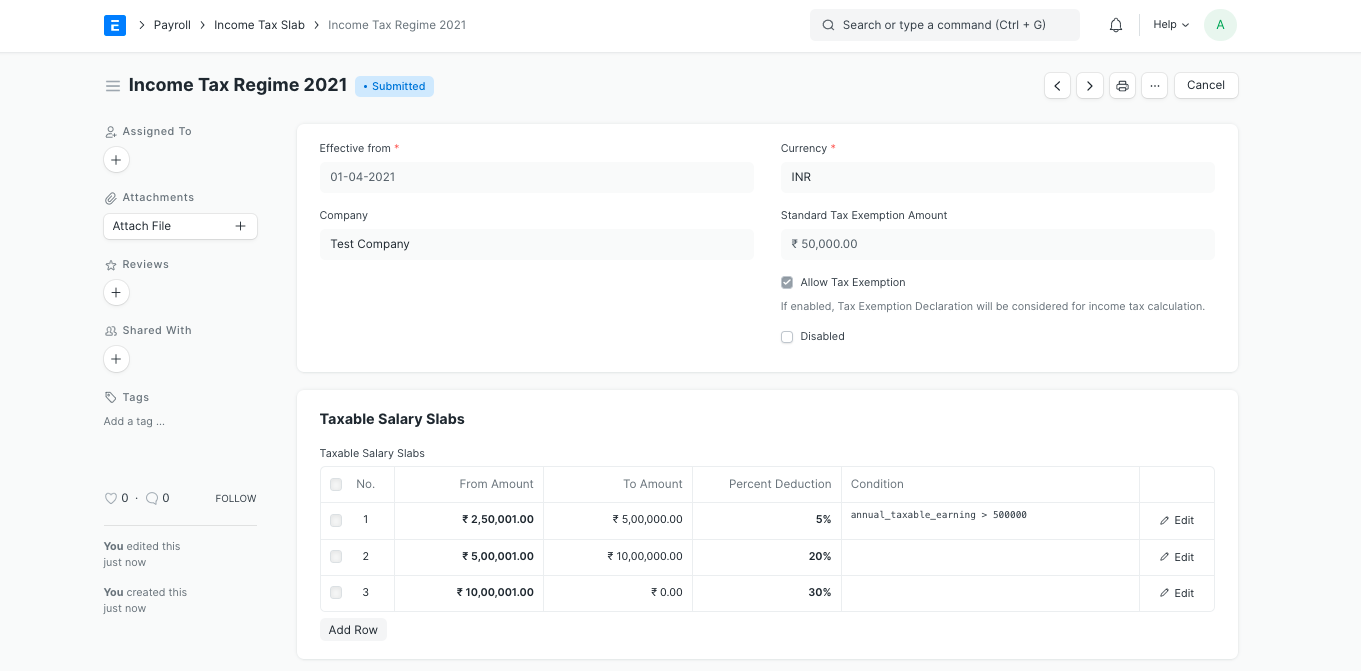

Enter the company name, the name of the IT Slab, and the date the Slab will become effective.

If applicable, select "Allow Tax Exemption" from the checkbox.

Publish and save.

2. Features

2.1 Tax Slabs

You can set the rate for various income slabs in the Tax Slab table. From Amount and To Amount must be specified in order to specify slab. From Amount is optional for the first slab, and To Amount is optional for the last slab. Both amounts are taken into consideration when calculating taxes based on taxable income.

The tax slab may apply depending on a number of factors. The Employee, Salary Structure, Salary Structure Assignment, and Salary Slip documents all have field names that can be used to create conditions.

Examples:

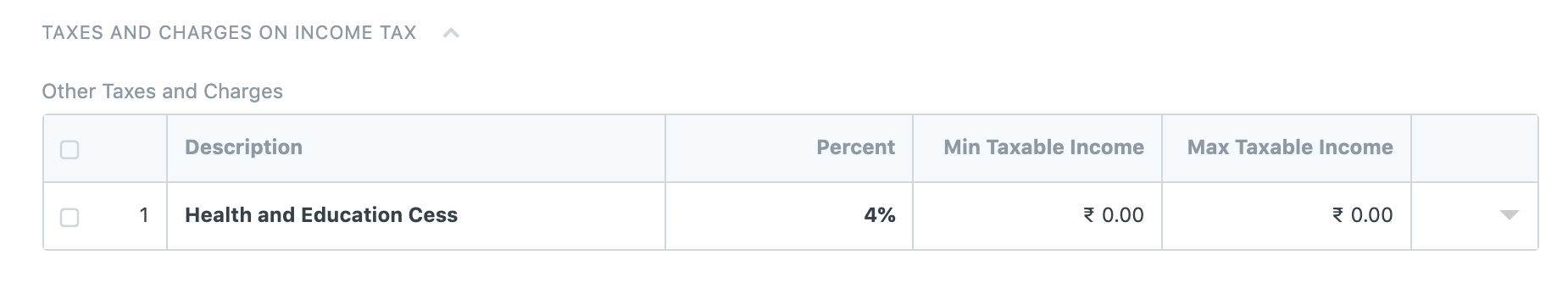

2.2 Other Taxes and Charges on Income Tax

You can enter any additional taxes that apply to the estimated income tax using this table. The minimum and maximum taxable amounts that will be subject to this tax can also be specified. For instance, everyone in India is subject to an extra Health and Education Cess in addition to income tax.

2.3 Other Properties

Allow Tax Exemptions:There may be tax exemptions available for a particular Income Tax Slab. Employee Tax Exemption Declaration and Proof Submission are taken into account, if enabled, while calculating taxes based on this tax slab.

Standard Tax Exemption Amount: The government-defined Standard Tax Exemption Amount may be placed here if exemption is permitted. In general, no documentation is required to qualify for this exemption, which is available to all workers covered by this income tax bracket.