Book Petty Cash Entry

Book Petty Cash Entry

Petty Cash is a small amount of cash on hand that is used to pay for expenses such as Travel, Telephone, etc. that are too small to warrant the writing of a check. Such entries can be made via Journal Entry in ERPNext.

To account for small cash expenses, follow the steps below:

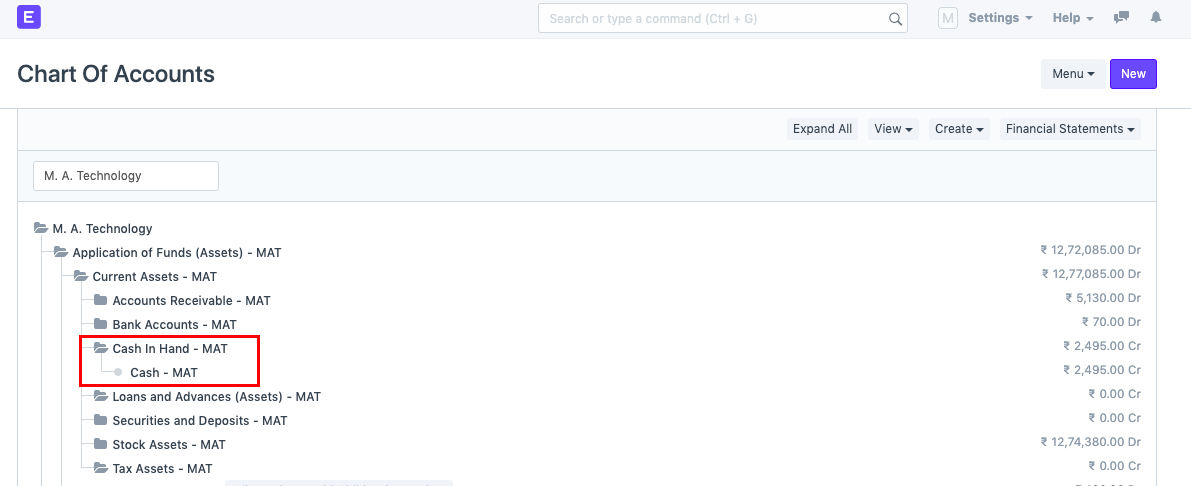

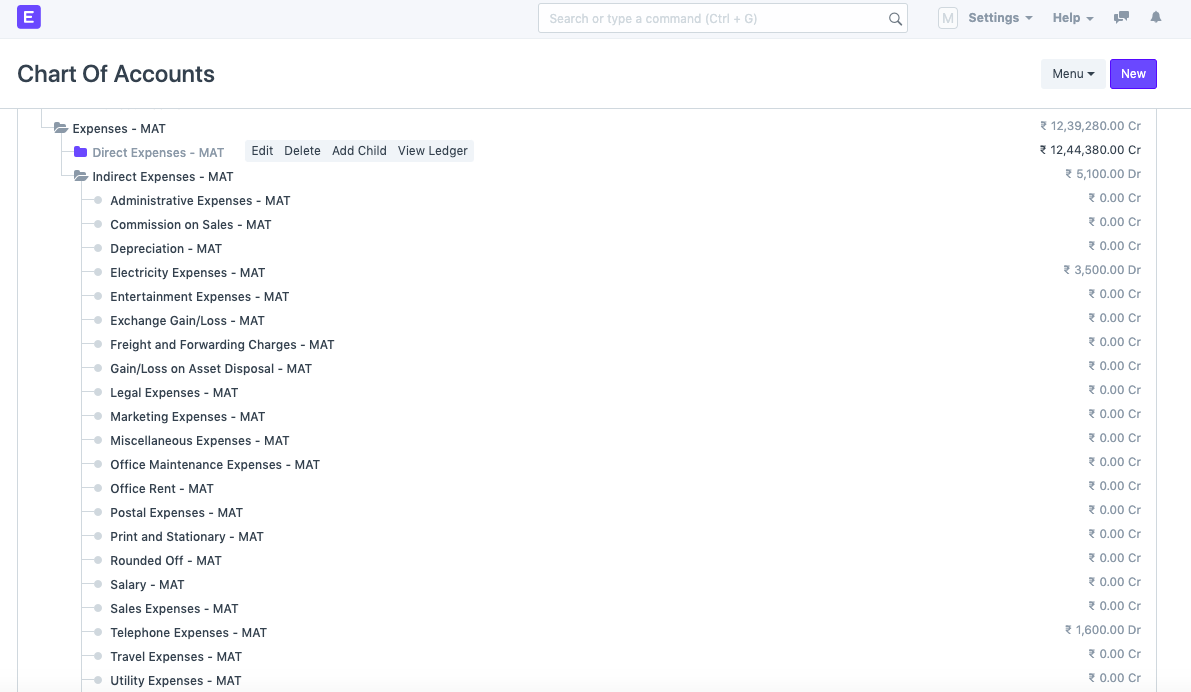

1) Establish accounts within the Chart of Accounts.

a) Cash Balance

b) Cost Accounting (under Indirect Expenses)

NOTE: The majority of these accounts will already exist. You may create a few more of your choosing if necessary. This link explains how to create the same thing.

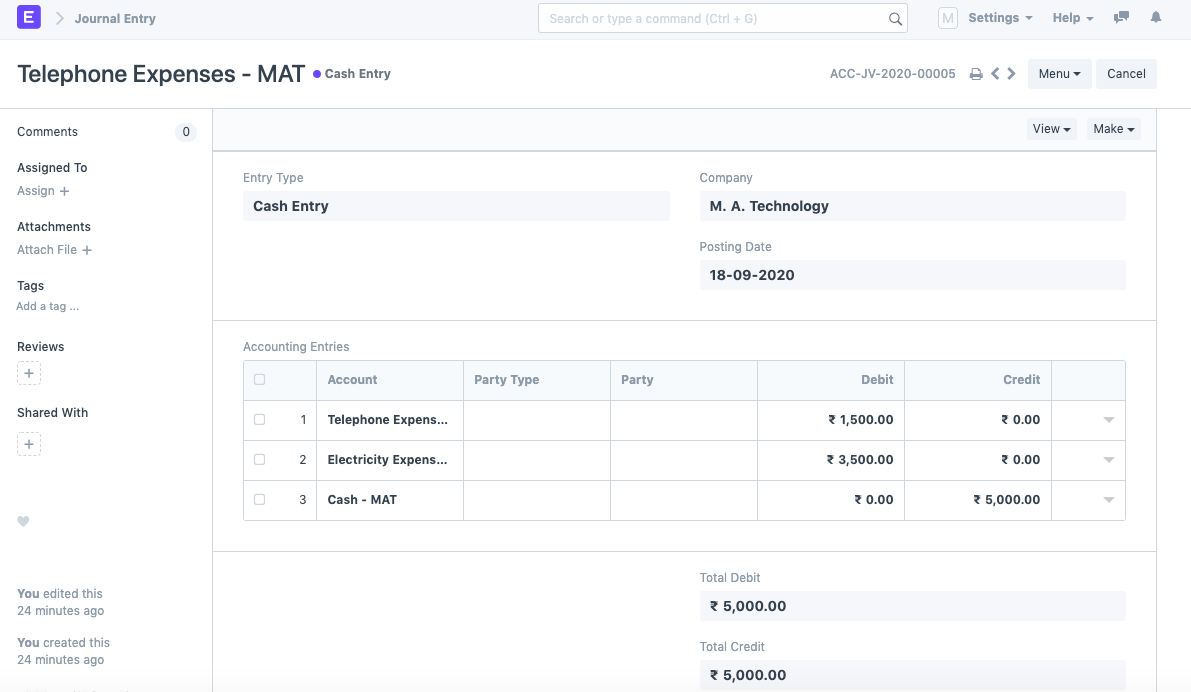

2) Generate a Cash Journal Entry (JV).

3) The default Cash account will be automatically populated in the Credit side row. You are able to edit this account

4) Insert the Account for Expenses into the table. Additionally, you can add multiple Expense accounts (such as Telephone Expense, Travel Expense, etc.) as separate rows. Ensure that the Debit and Credit columns are balanced.

5) You may also include the Reference number, Date, and Remarks for future reference.

6) Save and submit the form.

Using the View button on the Journal Entry Itself, you can view the Accounting Ledger.