Sales Return

Sales Return

A sales return is a sold item that is being sent back.

Frequently, businesses return items that have already been sold. Due to poor quality, failure to arrive by the scheduled delivery date, or for any other reason, the customer may decide to return them.

1. Prerequisites

It is suggested that you first create the following before making and using a sales return:

- Item

- Sales Invoice or Delivery Note

2. How to create a Sales Return

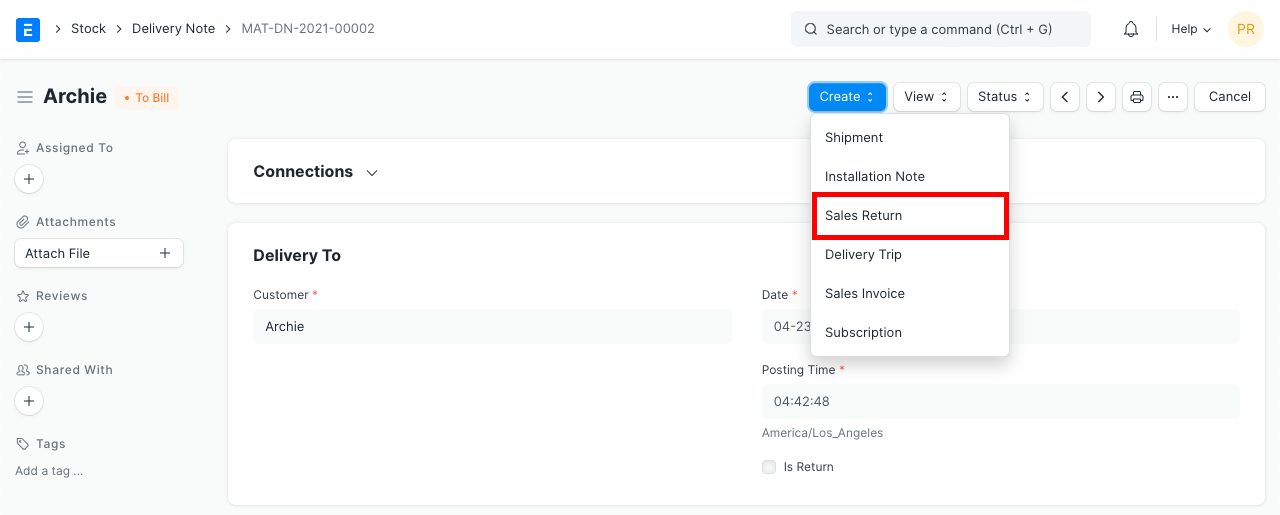

- Open the original Sales Invoice or Delivery Note against which the Client returned the Goods first.

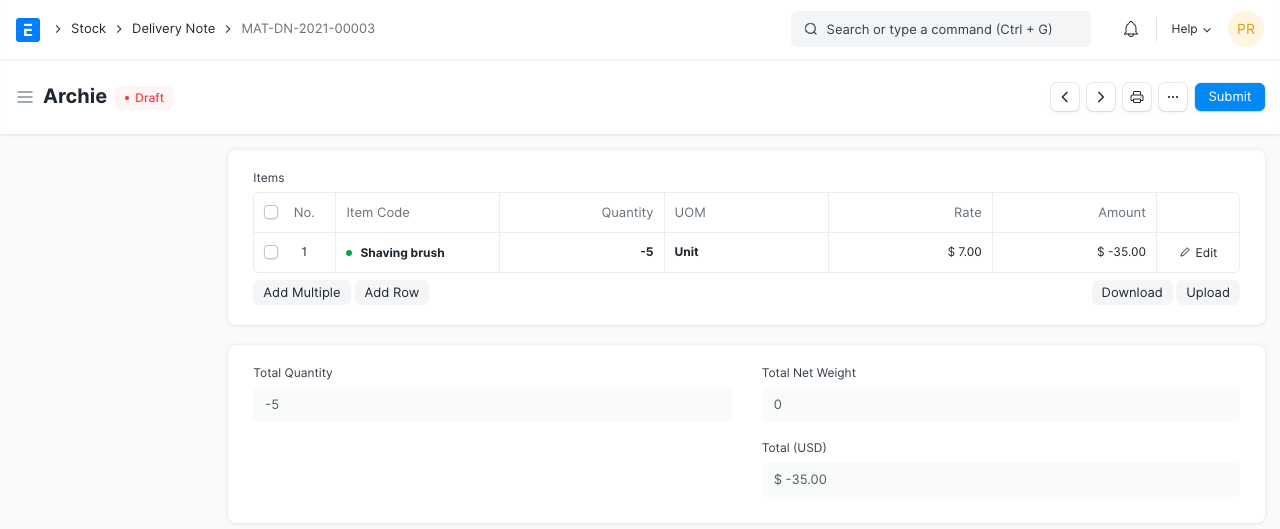

- Then select "Create > Sales Return," which will open a new Delivery Note with "Is Return" checked and negative values for the items, rate, and taxes.

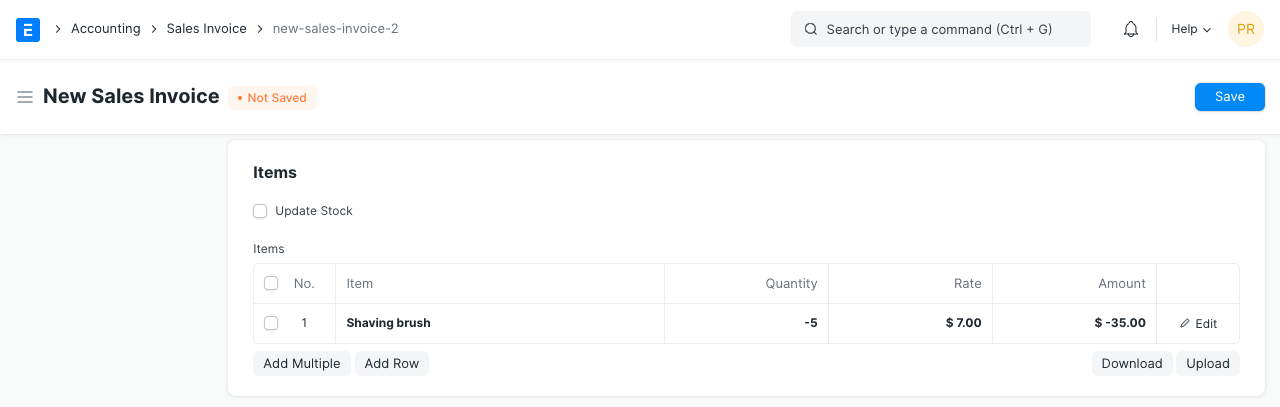

- You can also create the return entry against the original Sales Invoice, to return stock along with credit note, check "Update Stock" option in Return Sales Invoice.

- When a sales invoice or return delivery note is sent, the system will add more stock to the designated warehouse. Stock balance will increase in accordance with the original purchase rate of the returned goods in order to maintain accurate stock valuation.

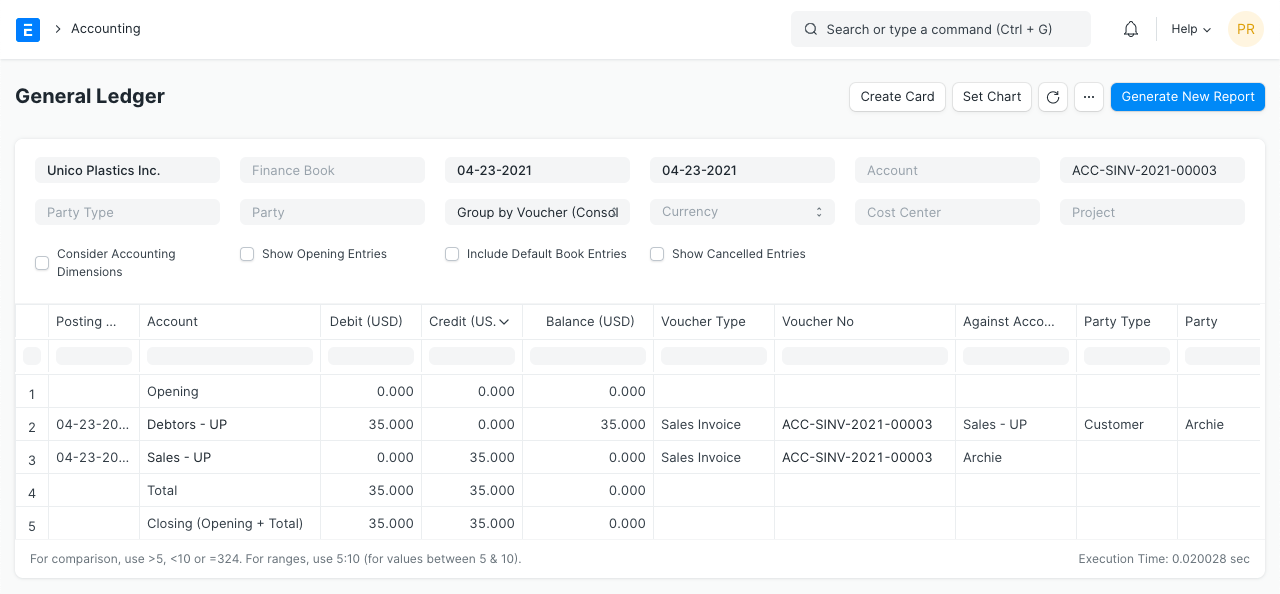

- In the event of a returned sales invoice, the relevant income and tax accounts will be debited and the customer account will be credited, as reflected in the accounting ledger.

In order to sync the balance of the warehouse account with the stock balance listed in the Stock Ledger, the system will also post an accounting entry against the warehouse account if perpetual inventory is enabled.

3. Impact on Stock Return via Delivery Note

Making a Sales Return in Relation to a Delivery Note

The original Delivery Note's Returned Quantity, as well as any Sales Orders connected to it, are modified.

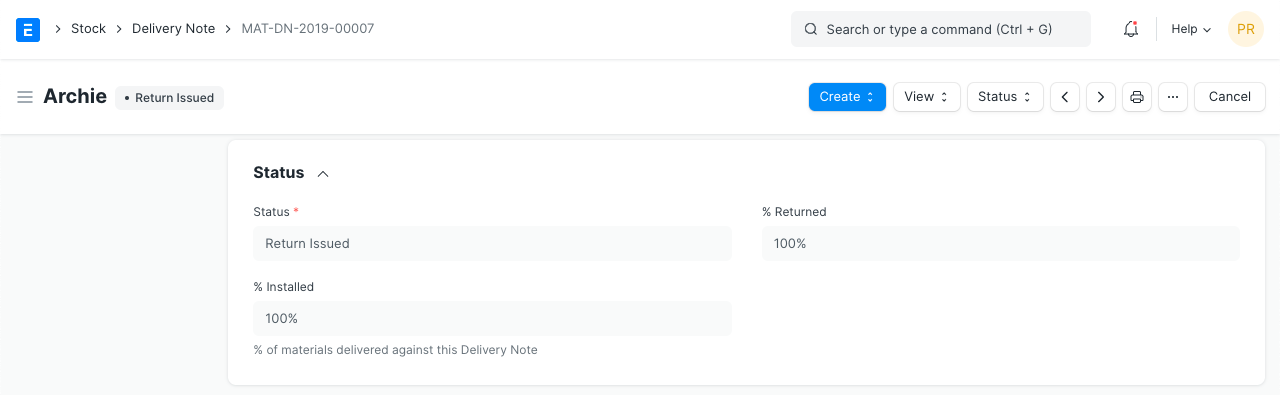

If 100% of the original Delivery Note is returned, the status is changed to Return Issued: