Calculating Freight in taxes in ERPNext

Calculating Freight in taxes in ERPNext

Use case: To calculate freight forwarding charges with tax rate

The steps are as follows when freight is to be included in forwarding charges as a tax rate:

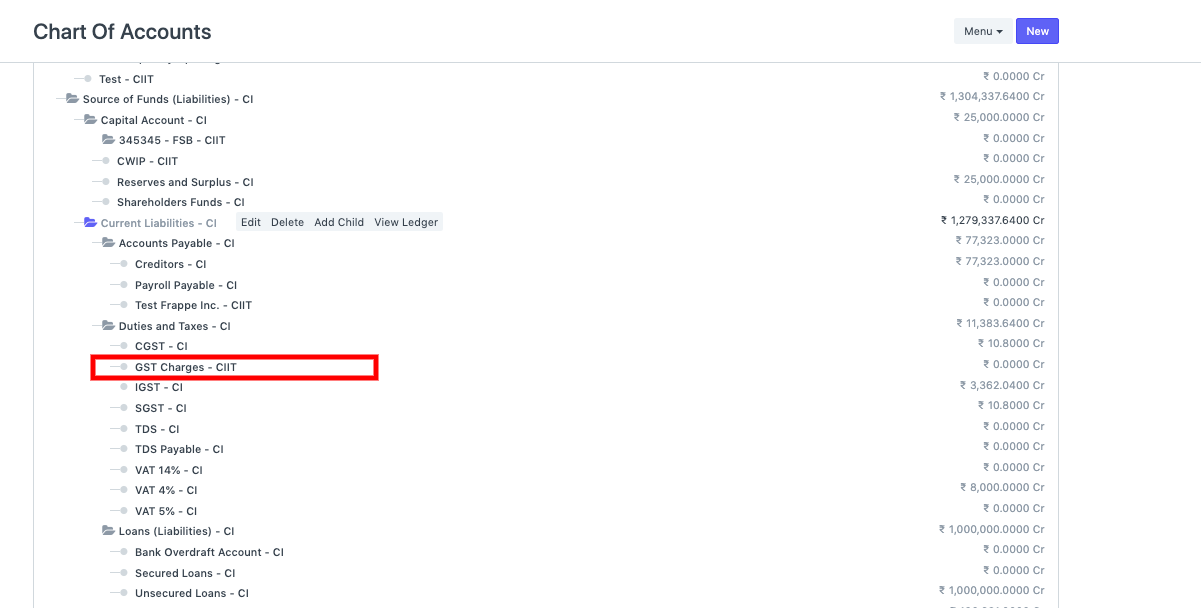

Instead of using the GST tax account in the taxations to calculate the freight costs, you can build a ledger in the taxes account explicitly in the Chart of Accounts.

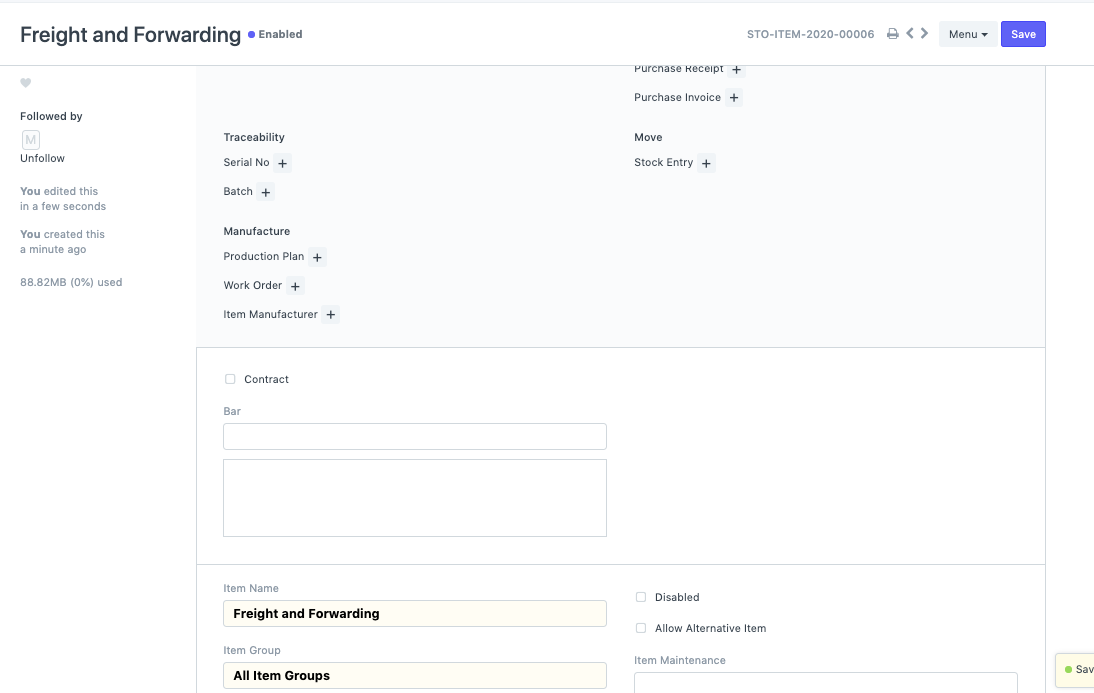

Make an item now with the name: Freight and Forwarding

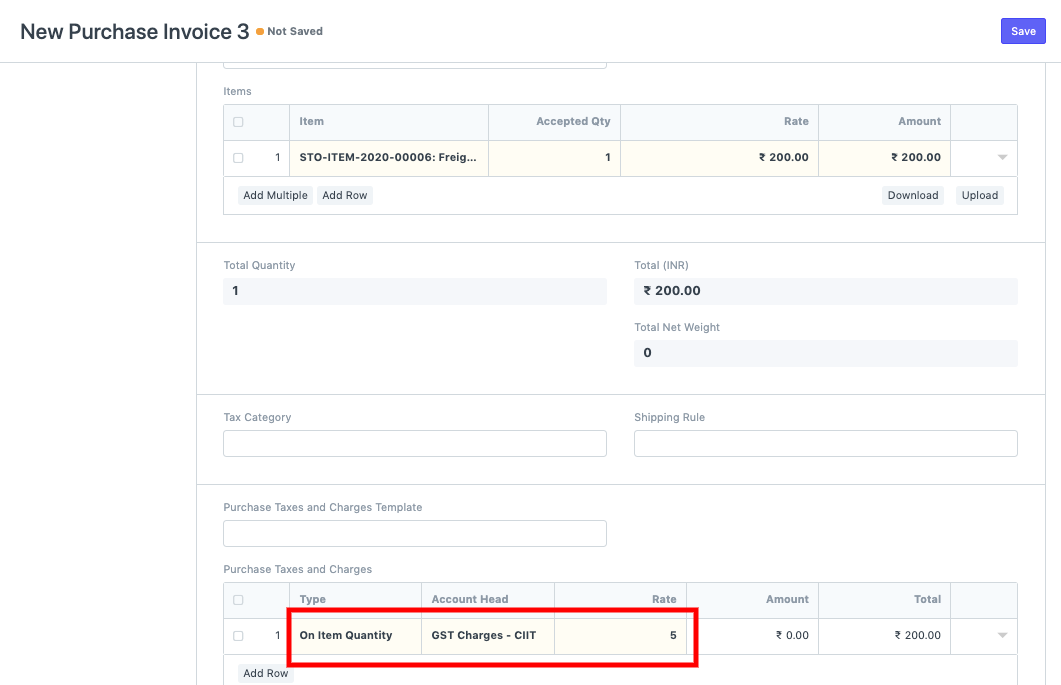

Now that this item has been added, you may construct a purchase invoice for the supplier and use it to determine the freight-related taxes. According to company policy, you can base the freight tax on the Net total or the Item Quantity.