Employee Benefit Application

Employee Benefit Application

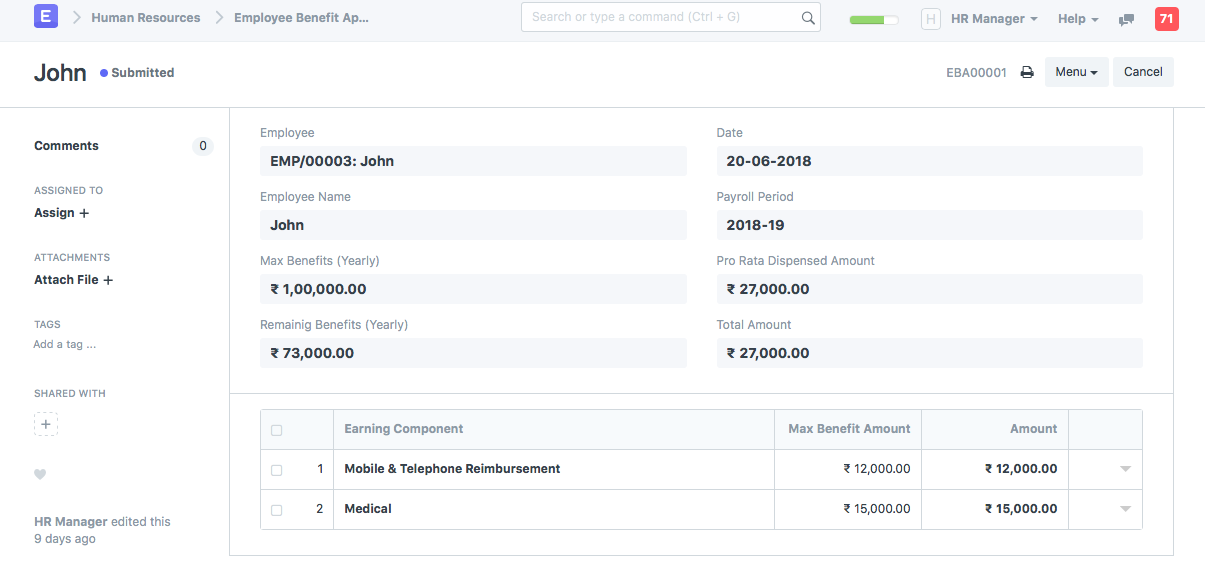

Flexible benefits are available to employees, who may choose to receive them pro rata (as a portion of their salary) or all at once when they apply for the benefit. The employee should make a new Employee Benefit Application in order to select from a variety of flexible benefits that they will receive on a pro-rata basis.

A new Employee Benefit Application must be made.

Human Resources > Payroll > Employee Benefit Application > New Employee Benefit Application

The employee can choose from the Earning Components that are a component of the employee's given Salary Structure after viewing the Max Benefits according to the Salary Structure Assignment. Also, users can enter the sum they want to see on their salary slip.

The distribution of the maximum benefit amount among the flexible earning components when creating the salary slip is based on the employee benefit application. The maximum benefit amount that is available to an employee will be dispersed proportionately to each flexible component that is present in the employee's wage structure if the employee fails to submit the employee benefit application prior to processing the payroll.

Note: Employees can only submit one Employee Benefit Application for a Payroll Period.

Employee benefit applications must include the full amount that the employee is entitled to receive on a pro-rata basis in accordance with the maximum benefit amount. However, if an employee's salary structure includes salary components that must be paid on employee benefit claims (salary component with pay against benefit claims), they may submit an application for employee benefits without include the funds designated for those components.

Additionally keep in mind that any components that will be paid out based on employee benefit claims may be included in the application but will only be paid out as a lump payment when the employee makes a claim for them.

Note: Flexible benefits are not included in the normal tax computation because they are often tax-exempt. Use Deduct Tax For Unclaimed Employee Benefits in Payroll Entry / Salary Slip while processing the Salary to tax these components at any point prior to the last payroll.