Book discount allowed and received separately

Book discount allowed and received separately

Discounts are commonplace in business. A discount is granted when a supplier of goods or services grants a customer a payment discount. In contrast, when a customer receives a discount from a supplier, the situation is inverted.

When you, as a supplier, offer a discount to a customer, it is considered an Expense, whereas when you, as a customer, receive a discount from your supplier, it is considered an income.

In ERPNext, discounts granted or received are not separately recorded. Typically, the amount booked is the final amount of the invoice (after discount). If you wish to book the discounts separately, however, you can follow the steps below:

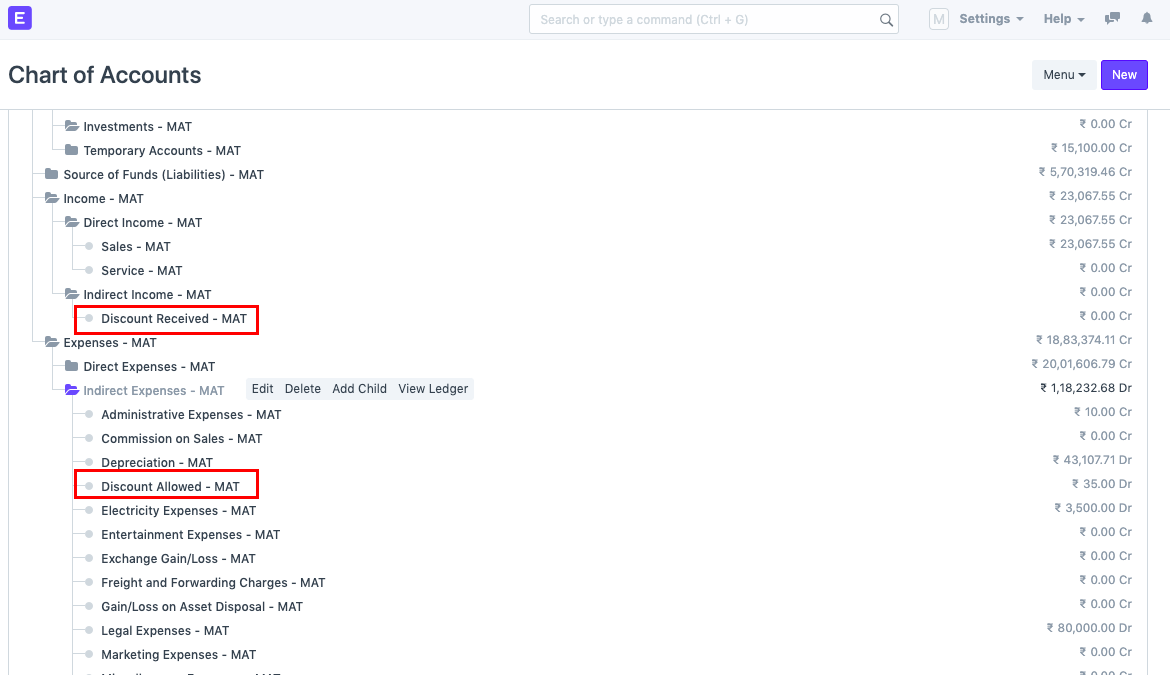

1) "Discount Allowed" is an example of an Expense, whereas "Discount Received" is an example of an Income. Create these two accounts in the Chart of Accounts as a result.

2) Create a bill and choose the item. Now, within the "Sales/Purchase Taxes and Fees" table, select the discount account head based on the transaction and enter a negative discount rate.

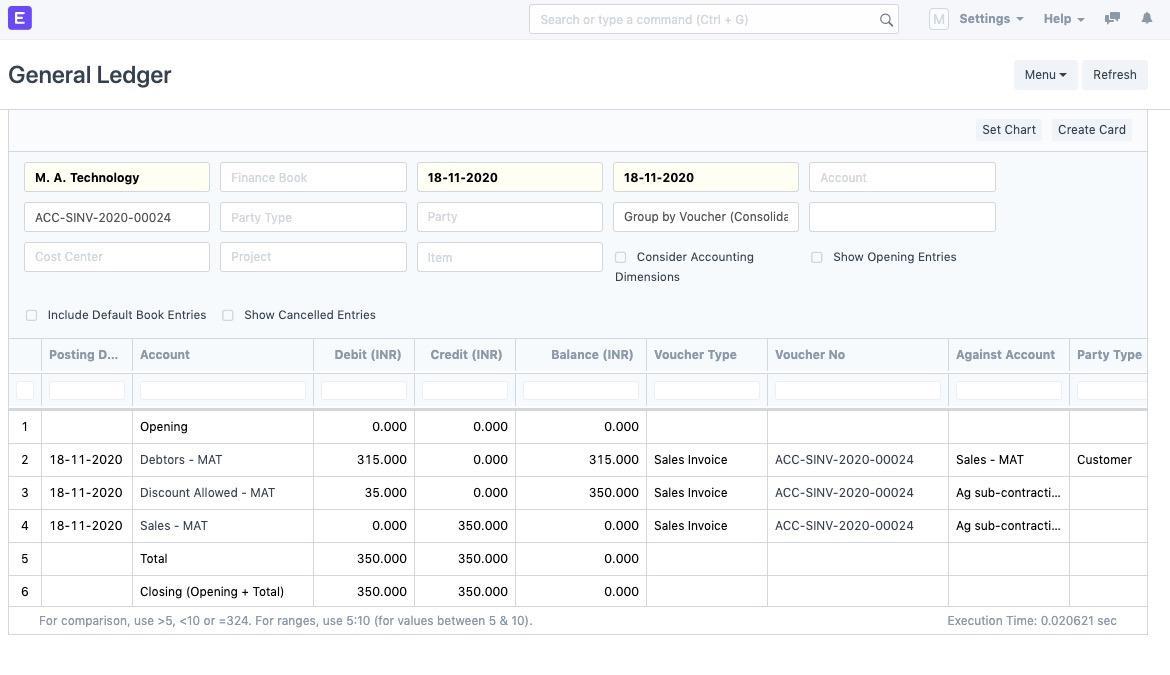

For instance, if we are creating a Sales Invoice and giving the customer a 10% discount, the 10% discount is recorded in a separate "Discount Allowed" account. See the screenshot below for clarification.

As shown in the preceding image, the total amount of the invoice excluding the discount is Rs. 350. After applying a 10% discount, the total amount of the invoice is now Rs. 315. The Rs. 35 discount is recorded in the Discount Allowed account, which represents an expense for the supplier. View the screenshot below to see how the accounts are recorded.

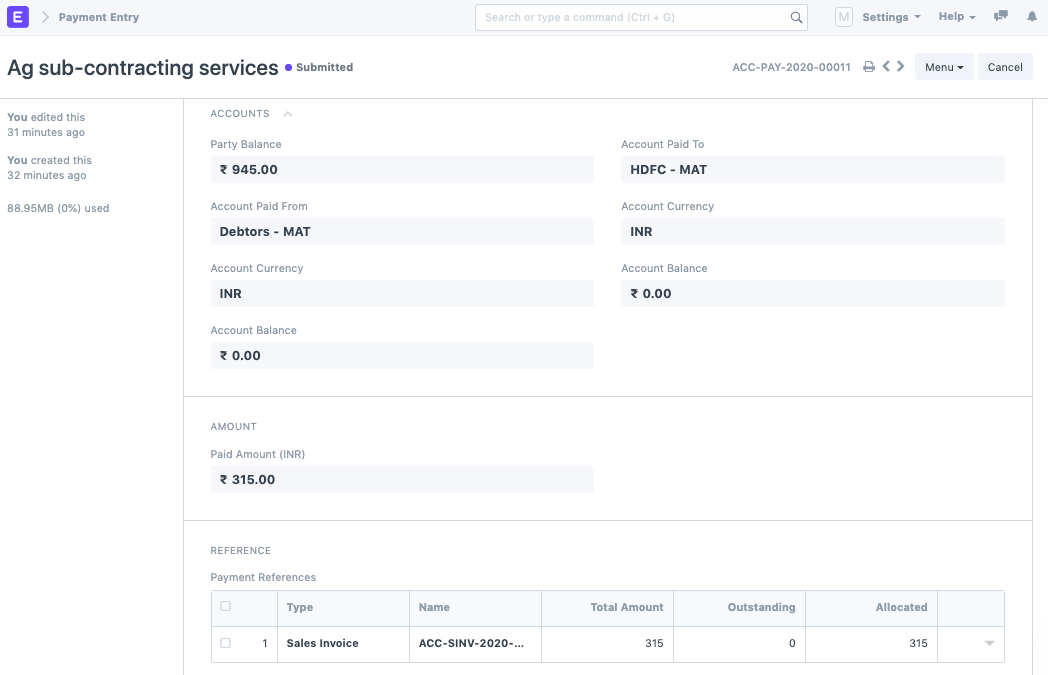

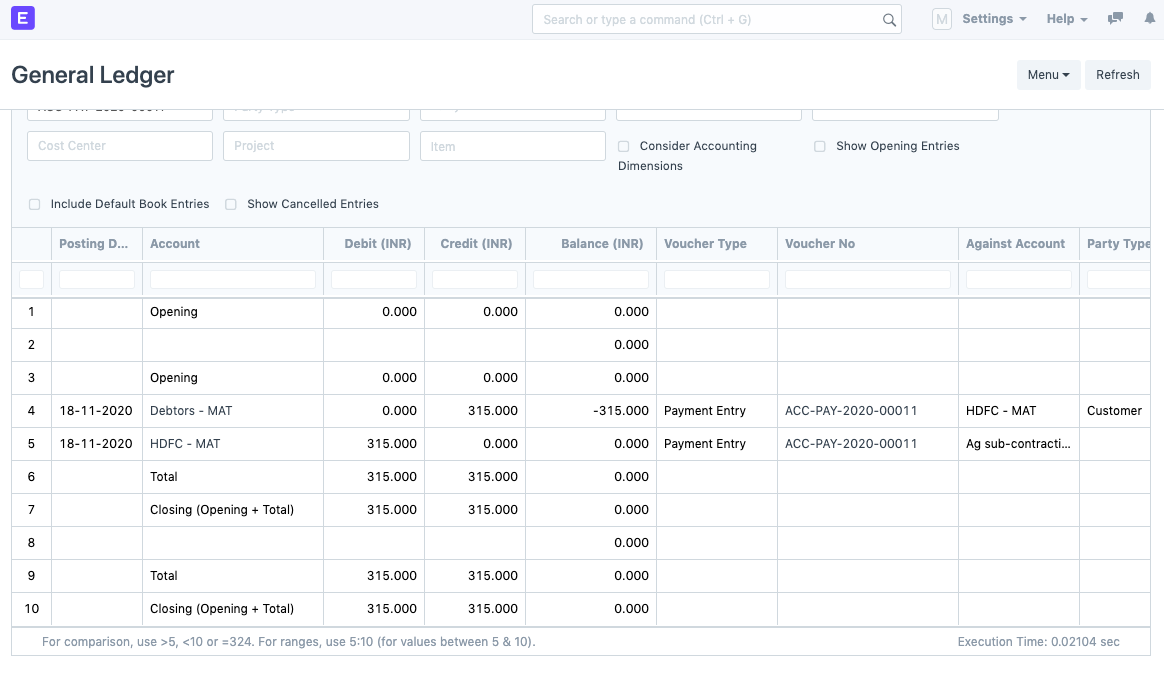

3) Proceed to make the final payment via Payment Entry as depicted in the following screenshots:

Note: The same procedure can be used to create a Purchase Invoice. In this case, however, the account selected in the Purchase Taxes and Charges table will be "Discount Received," a revenue account.