Employee Benefit Claim

Employee Benefit Claim

Employee Benefit Claims give them the ability to: 1. Request flexible benefits that will be paid in one lump payment; (if Salary Component is Pay Against Benefit Claim) 2. When Deduct Tax For Unclaimed Employee Benefits is selected in Payroll Entry / Salary Slip, claim tax exemption for flexible perks received pro rata as part of compensation.

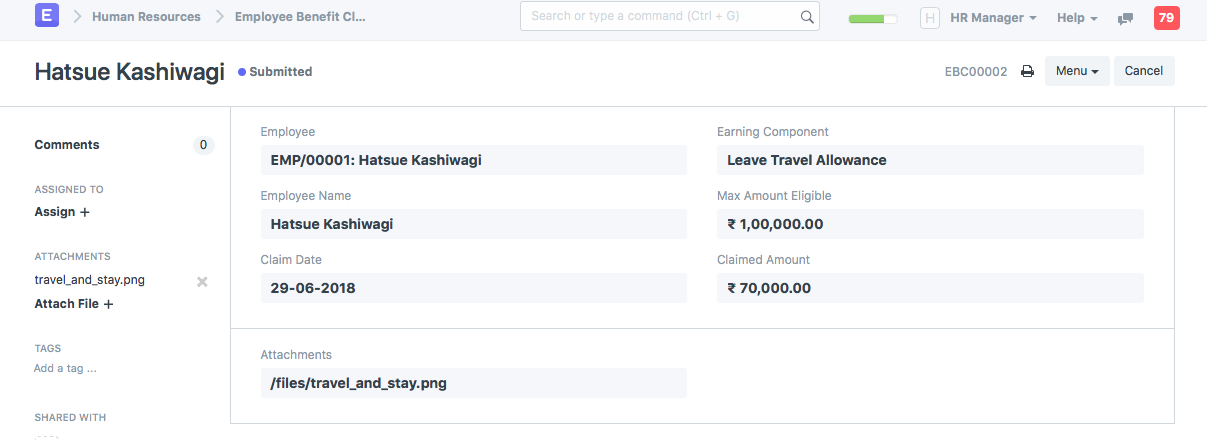

By visiting, you can create a new Employee Benefit Claim.

Human Resources > Payroll > Employee Benefit Claim > New Employee Benefit Claim

Employee can view their eligible amount according to their assigned salary structure here and claim the amount they want to receive as a part of their subsequent salary. The quantity of money that is paid out to employees in the form of a salary is determined by the number of hours they work each week.

Note: Flexible benefits are not included in the normal tax computation because they are often tax-exempt. Use Deduct Tax For Unclaimed Employee Benefits in Payroll Entry / Salary Slip while processing the Salary to tax these components at any point prior to the last payroll.