Gratuity Rule

Gratuity Rule

Version 13 introduces this feature, which will be included in a separate Payroll Module.

To calculate the gratuity amount, a set of rules established by the federal or state governments is applied.

Several gratuity rules based on different regions can be defined in ERPNext.

Go here: to access the Gratuity Rule.

Home > Payroll > Gratuity Rule

1. Prerequisites

Creating the following is suggested before implementing a gratuity rule:

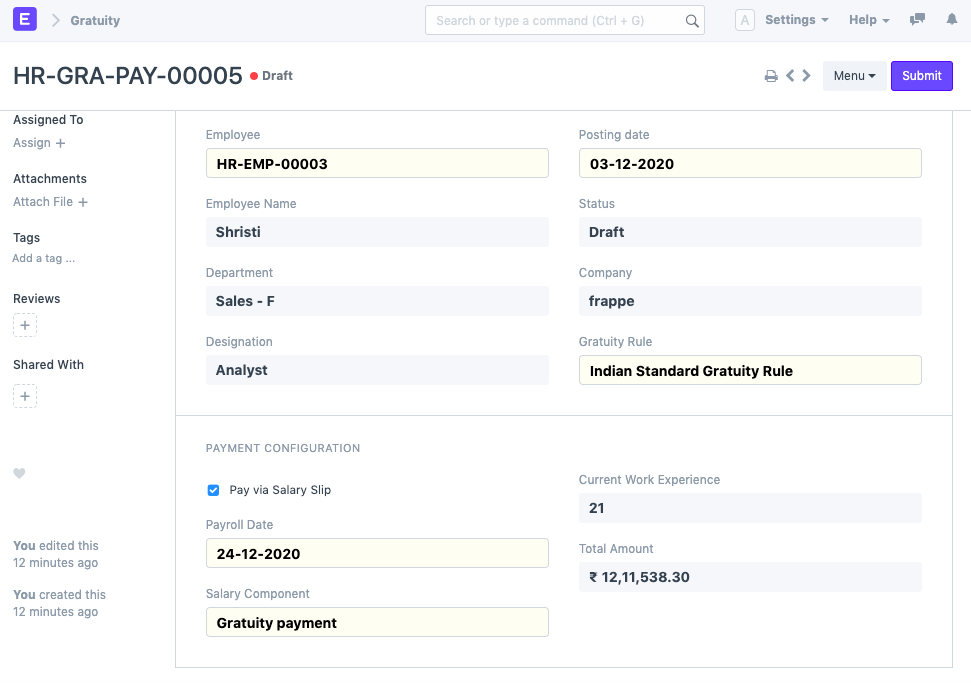

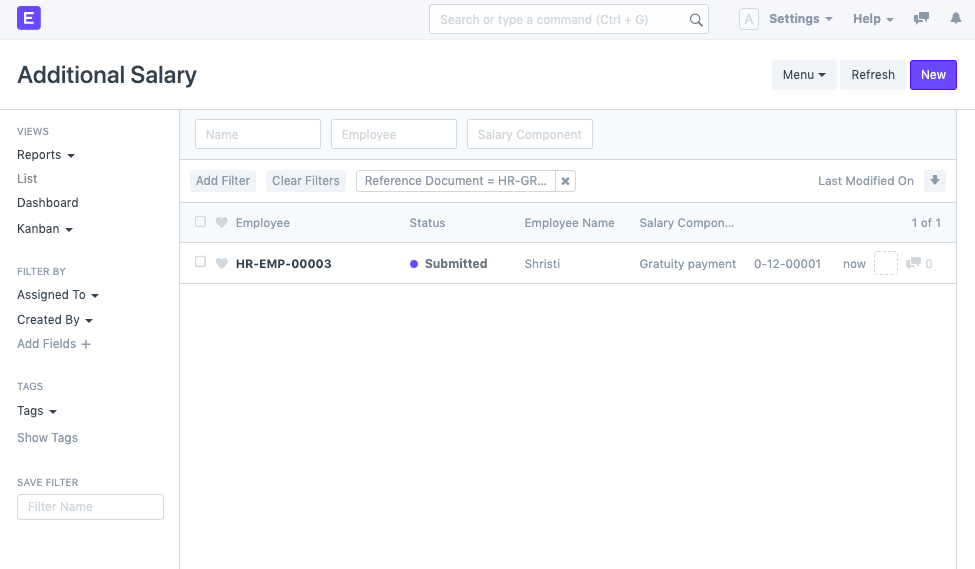

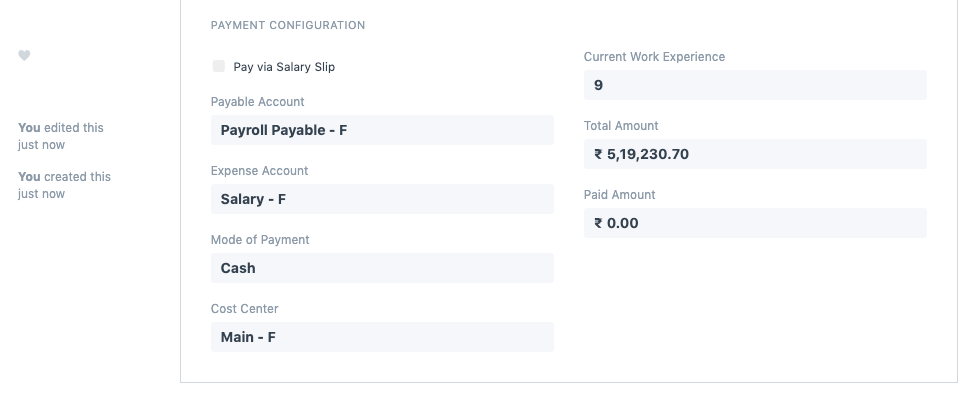

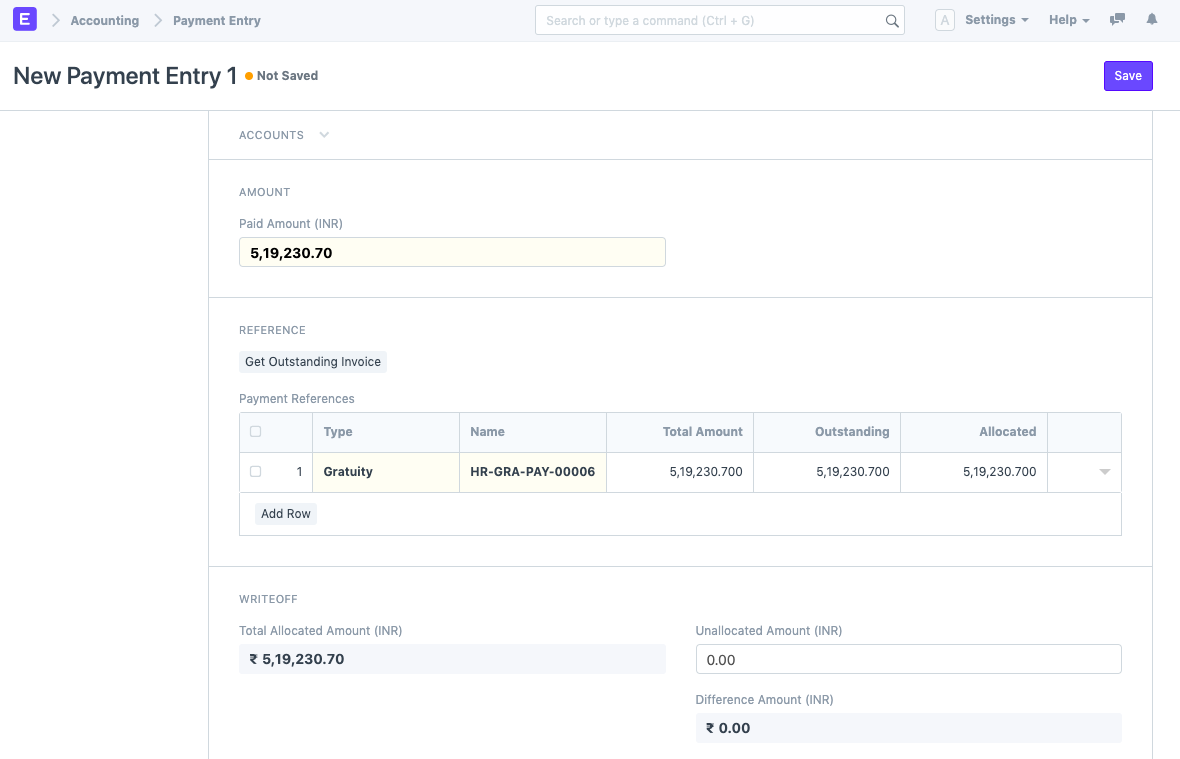

Employee

Salary Component

2. How to create Gratuity Rule

Accessing the Gratuity Rule > New

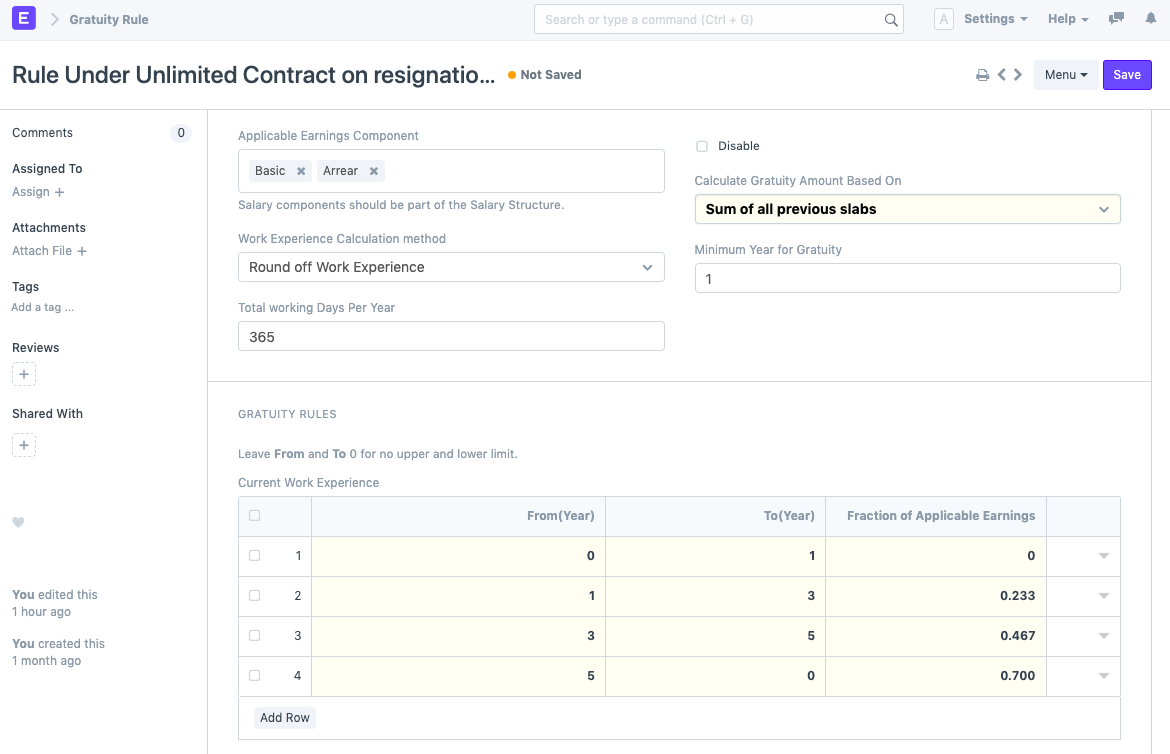

Choose the relevant components. These salary components are taken into account while calculating gratuities.

"Calculate Gratuity Amount based on" should be chosen.

Describe the Gratuity Rule

Save

3. Additional Properties

This is a definition of a few of the extra attributes utilized for calculating gratuities.

3.1 Work Experience Calculation method:

Two different methods for calculating work experience are provided by ERPNext.

Work Experience technique, round off Finish off your previous encounter. For instance, if an employee has four years' worth of experience, four years' worth of experience will be considered.

Choose the most recent year.

3.2 Calculate Gratuity Amount Based On:

To comprehend the math, let's take a look at the sample below.

- Current slab: If the computation of the gratuity amount is based on the current slab, the amount will be calculated as the total of the applicable earnings components, the fraction of the applicable earnings, and the work experience (measured in years). If an employee has five years of experience, according to the aforementioned gratuity rules or slab, they come under the third slab. The formula for determining the gratuity amount is as follows:

Gratuity amount = 5 * 0.467 * (Arrear + Basic)

- Sum of all previous slabs: If the computation of the gratuity amount is based on the sum of all prior slabs, the amount will be the product of all individual slabs up to the experience year and the sum of the applicable earnings component. If an employee has five years of experience, the gratuity amount will be calculated according to the aforementioned rules/slab as follows:

Gratuity amount = [(1 * 0) + (2 * 0.233) + (2 * 0.467)]*(Arrear + Basic)