Finance Book

A Finance Book is a book against which all the accounting entries are booked.

There are numerous finance books available. Think of two books, one for stockholders and the other for tax authorities. If you have to report depreciation and other values in a variety of ways due to regulatory restrictions, this is helpful. Additionally, you can submit alternative balance sheets for internal reporting using this.

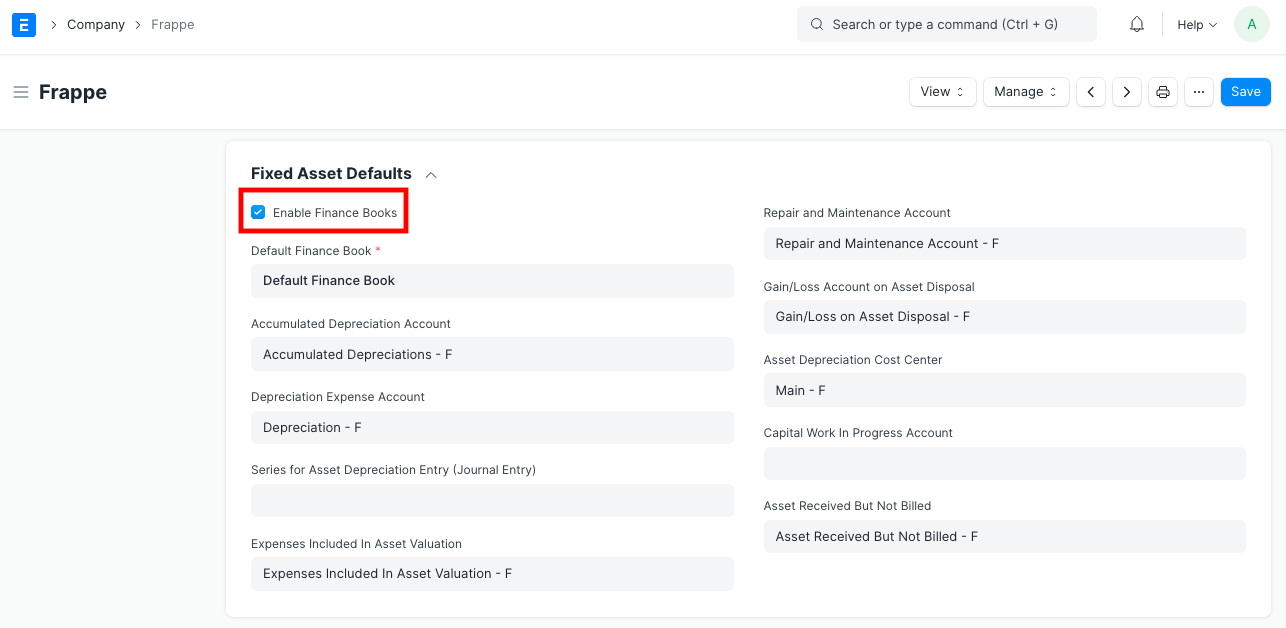

You must select Enable Finance Books under the Fixed Asset Defaults section of the Company master in order to use Finance Books.

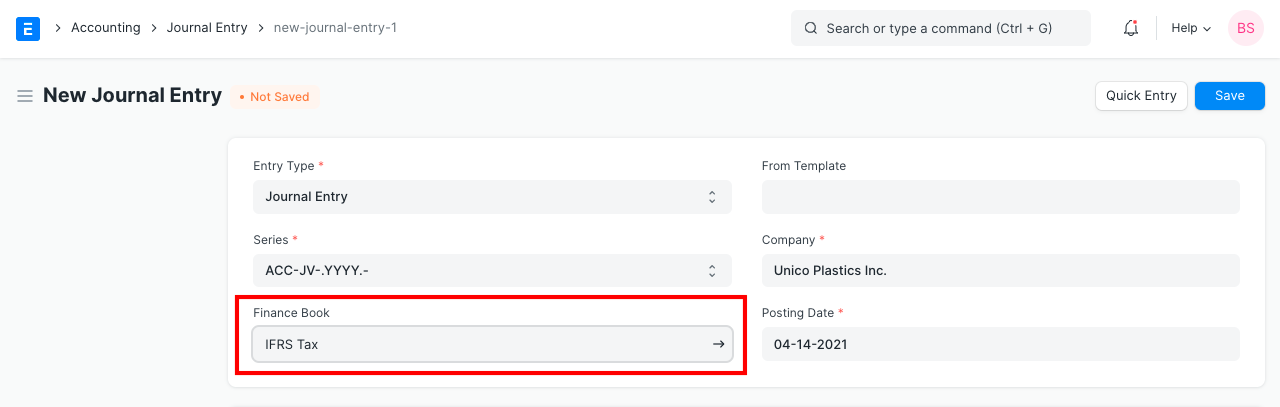

The setup of a finance book is not required. However, if you decide to create numerous finance books, you can enter data against a particular finance book by selecting it in the Journal Entry window. A journal entry's blank finance book field indicates that the entry will be accessible in all finance books.

Many times, a company may utilize several depreciation methods (Straight Line, Written Down Value, Double Declining Balance) for fixed asset depreciation for various finance books. For each Finance Book, you can create a distinct depreciation schedule. The schedule-aligned automated depreciations will then be recorded against that Finance Book.