Employee Tax Exemption Proof Submission

Employee Tax Exemption Proof Submission

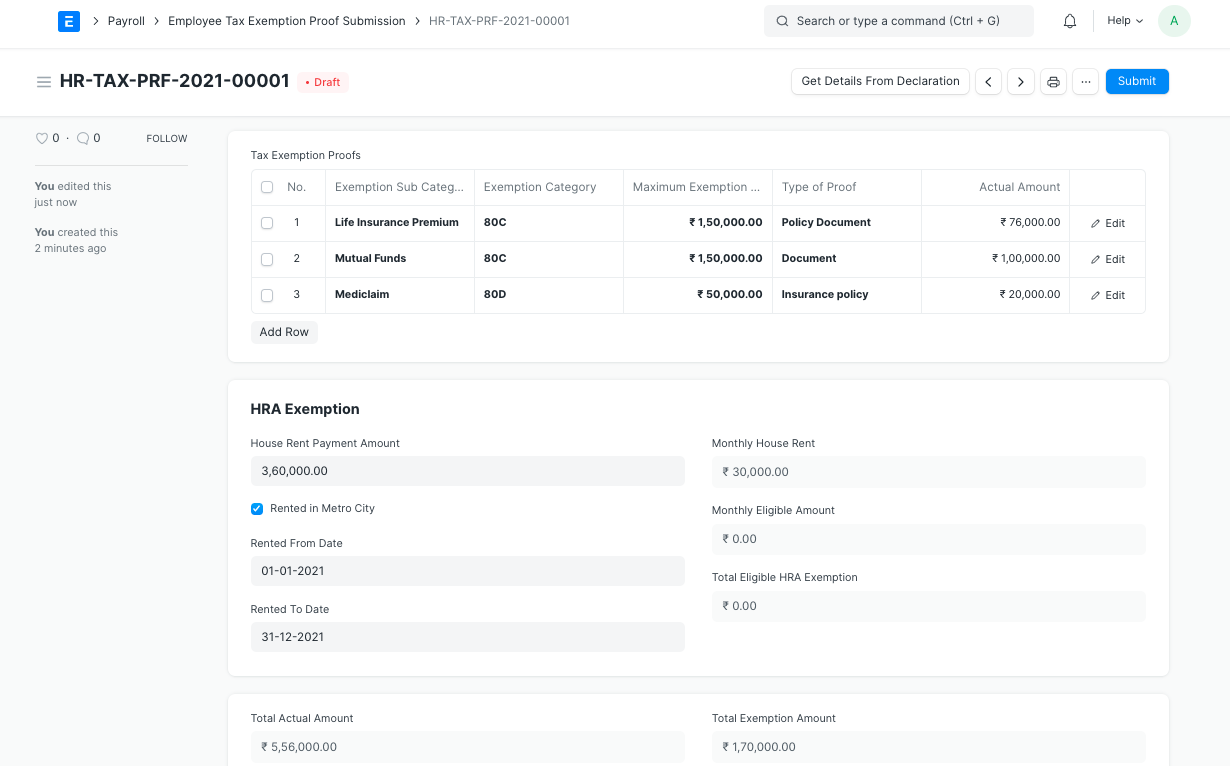

Workers must provide documentation for all expenses for which they are claiming a tax deduction. The Employee Tax Exemption Proof Submission document can be used to do this.

Employees can submit as many proofs as they desire, unlike the Employee Tax Exemption Declaration, which is typically done at the end of a Payment Period.

Note: Before producing an Employee Tax Exemption Proof Submission, create an Employee Tax Exemption Declaration.

Visit the following to access Employee Tax Exemption Proof Submission:

Home > Human resources > Employee Tax Exemption Proof Submission

1. How to create an Employee Tax Exemption Proof Submission

If you select "Submit Evidence" from the Employee Tax Exemption Declaration, the information is already fetched. To manually create a "Employee Tax Exemption Proof Submission," however, follow these instructions.

Click on New under the Employee Tax Exemption Proof Submission list.

Add information as necessary. Include the "Kind of Proof" as well (documents, receipts, etc.).

Attach the proofs in by clicking on the Attach button at the bottom.

Input the amount of the house rent payment, the rented from and rented to dates.

Publish and save.

The Total Exemption Amount will be exempted from annual taxable earnings of the employee while calculating the tax deductions in the last payment.

Even if employees submit documentation of their exemption at any time during the payroll period, ERPNext will only take this into account for adjusting the final taxes based on the proof at the last payroll of the payroll period. Check the Deduct Tax For Unsubmitted Tax Exemption Evidence option while processing Payroll Entry if you need to alter any additional tax received or think about proof submission of employees anytime before the last payroll.

Regional - India In India, the Home Rent Allowance (HRA) is exempt from taxation for the current fiscal year to a minimum of:

- the real HRA amount provided by the employer.

- Real rent payments are less than 10% of the base pay.

- If the employee is staying in a metropolis, they will receive 50% of their basic wage (or 40% in a non-metropolis).

Employees must include proof of their HRA Exemption with the Employee Tax Exemption Proof Submission. In the final payment of the Payroll Period, ERPNext will determine the exemption that is HRA-eligible and exempt it when determining the taxable earnings.

Note: HRA component shall be configured in Company for HRA exemption to work